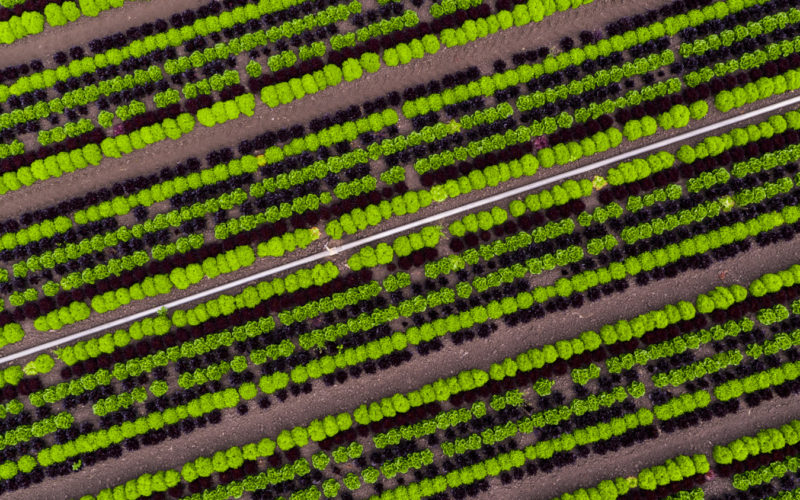

At American AgCredit, we offer highly experienced agents and crop insurance policies custom-designed to manage your risk and protect your operation.

We know the threat that crop failure or natural disaster can pose to your operation. Our expert insurance agents are ready to work with you to tailor a personalized plan that helps mitigate risk and keeps your business safe.

Depending on the nature of your operation, we offer targeted crop insurance plans to protect your business.