In these uncertain times, we stand by our customers and the agricultural community. While many of our offices remain closed except by appointment, there are several ways to do business with us remotely. To learn more about our response to COVID-19, please click here.

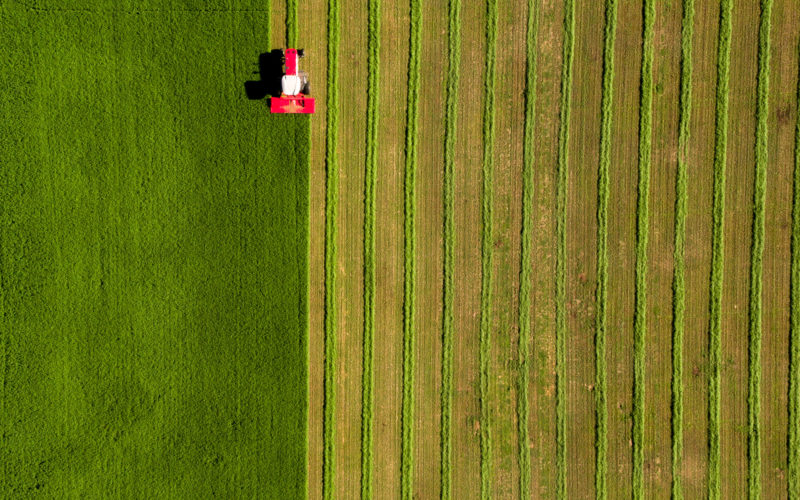

Leasing for Agriculture

Every agricultural operation depends on proper facilities and buildings and reliable equipment. But the real value of equipment comes from operation — not ownership. We offer flexible leasing options to meet the varying needs of your business, ensuring you always have access to the best equipment.

Why Lease?

Leasing can assist in supporting the foundational needs of your business by offering an alternative to a large cash outlay on direct purchases and allowing you to stay up to date with equipment and technology. With no down payment required, leasing allows you to reserve your capital for where it can work the hardest for you. To be eligible for our leasing programs, individuals must be owners of agricultural land or engaged in production agriculture.

What American AgCredit Leases

- Facilities and buildings

- Solar projects

- Processing lines

- Tractors, trailers, forklifts and other vehicles

- Fruit bins

- Equipment

- Packing equipment

- Irrigation systems

- Wine barrels

- Greenhouse structures

- Cooling and drying equipment

- …and much more

Leasing Benefits

- Requires no down payment

- Helps conserve working capital

- Helps minimize the risk of equipment becoming obsolete

- Can provide steady, annual tax write-offs

- May help you accelerate the write-off on certain assets

Leasing Programs

Our spectrum of leasing programs allows us to tailor a lease package based on what’s best for your business. True lease or capital lease? We will work with you to get the most beneficial lease structure for your operation. Our flexible portfolio of options includes the following.